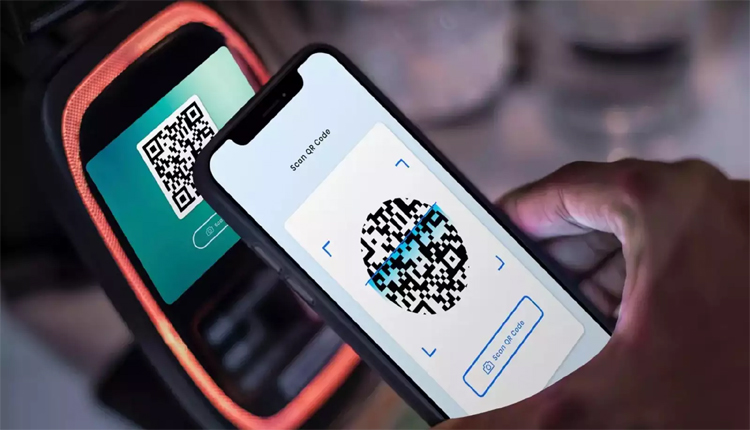

New Delhi: The government of India has sanctioned an incentive scheme for BHim-UPI transactions, a big step towards promoting digital payments. By offering rewards on transactions of up to ₹2,000, the scheme, which will be operational from April 1, 2024, to March 31, 2025, would incentivize retailers to use digital payments. For this purpose, the government has sanctioned Rs. 1,500 crore.

Scheme’s Advantages The merchant incentives: Small and medium enterprises that get UPI payments of up to ₹2,000 would be incentivized 0.15% per transaction. Bank Motivations: Banks will also receive incentives to contribute towards enhancing the infrastructure for digital payments.

MDR = zero: Customers will conduct fee-free transactions, thus encouraging cashless transactions.

How Motives Will be Shared For example, the trader receives ₹1.5 as a reward when a customer pays using UPI for goods worth ₹1,000. Banks will get paid 80% of their claims upfront, while the remaining 20% will depend on fulfilling technical performance criteria.

Government Plans and Goals Promote digital payments and a cashless economy. Enable small enterprises by driving UPI adoption among their peers. Boost digital payments in rural and small town regions.

Make System Efficient: Encourage banks to possess low technical downtime and high system availability.

UPI Transaction advantages Easy Transactions: payment simple straight forward rather than cash. No Extra Charges: For neither customers nor retailers, there are no extra charges. Direct bank transfers: no intermediary involved.

Digital transaction records ease loan approvals. Zero MDR Rule On RuPay debit cards and BHIM-UPI transactions, the government already did away with Merchant Discount Rate (MDR).

The new incentive scheme induces small businesses particularly to adopt digital payments. With a target of ₹20,000 crore worth of digital transactions in the 2024–25 financial year, the government is aiming.

Comments are closed.