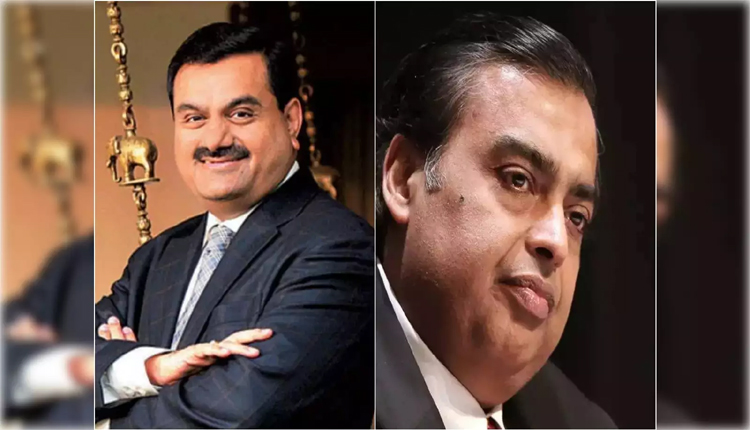

Mumbai: Gautam Adani has a well-established footprint in the FMCG space through the highly leveraged Fortune brand in edible oils and grocery products. Now, the conglomerate is going to make itself even more secure with the acquisition of Tops, a prominent brand in the ketchup and also processed food space. This somewhat resembles Mukesh Ambani’s strategy to expand Reliance’s retail empire, leaving us with a query—will Adani be able to challenge Reliance’s fort in the sector?

With a significant scale-up in the FMCG market by acquiring several small brands and strengthening its foothold in the grocery and consumer goods segments, Mukesh Ambani led Reliance Retail and Reliance Brands to accelerate way faster. For example, the success of Campa has revitalised it into a strong competitor to foreign colas. Reliance has also launched a brand, ‘Independence,’ for a larger number of grocery products, competing with others like Fortune from Adani.

Buyout strategy of Adani Wilmar

Adani Wilmar Limited (AWL) achieved a significant milestone on Tuesday when it revealed plans to purchase GD Foods Manufacturing, which owns the Tops brand. The deal has been amended and will go through different phases of executions.

As per an official statement released by Adani Wilmar, the company will first purchase an 80 percent stake in GD Foods, with the remaining 20 percent to be acquired in phases over the next three years. In FY2023-24, GD Foods has achieved a revenue of ₹386 crore, with an EBITDA of ₹32 crore.

Expanding Market Reach

Founded in 1984, GD Foods has developed a strong regional brand presence for its product Tops, which is a household name across seven states in North India. The company has its products available at more than 150,000 retail points in the region. With an eye on expanding its operations in a big way, Tops is likely to benefit from the Adani Group’s stronghold network while also being able to operate with a lot of resources now. At the same time, Adani Wilmar will also be able to strengthen its product portfolio to go beyond its existing core areas.

Therefore, the acquisition of GD Foods is complementary to our long-term vision juntas. The decision will allow us to better meet the changing needs of Indian households and beef up our FMCG portfolio footprint.”

This new acquisition would further strengthen Adani Wilmar’s presence, making them a competitive player in India’s cut-throat FMCG space, paving the way for a bigger face-off ahead between Adani and Reliance among a few key players of India Inc.

Comments are closed.