New Delhi: Is cash becoming obsolete in Indian wallets? The Unified Payments Interface (UPI) has shattered all records yet again, clocking a staggering 20.70 billion transactions in October alone – the highest monthly figure ever!

Operated by the National Payments Corporation of India (NPCI), this digital powerhouse is revolutionising payments, from bustling cities to remote villages.

October’s volume surged past September’s 19.63 billion and August’s 20.01 billion, with a whopping ₹27.28 lakh crore transacted – up from ₹24.90 lakh crore the previous month. Year-on-year, transaction volume jumped 25%, while value rose 16%. The peak? On October 18, a staggering 754.37 million transactions took place, setting a single-day record since the inception of UPI. Average daily deals hit 668 million, with value climbing to ₹87,993 crore from ₹82,991 crore in September.

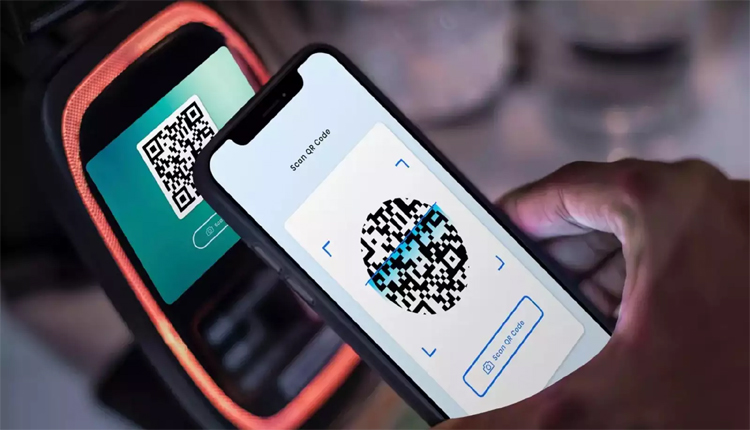

Experts attribute this boom to the festive season frenzy, expanding digital infrastructure, and QR code adoption by merchants big and small. Rural India is embracing UPI wholeheartedly, pushing the nation closer to a cashless economy.

Not just UPI – Immediate Payment Service (IMPS) transactions rose 3% to 40.4 crore (₹6.42 trillion value, up 8%), while FASTag volume grew 8% to 36.1 crore (₹6,686 crore value, up 4%), reflecting heavier highway usage during festivals.

As Indians swipe phones instead of notes, UPI’s meteoric rise underscores a seamless, inclusive financial future.

Comments are closed.