New Delhi: Have you forgotten your UPI PIN during a rush transaction? You can now avoid the hassle of searching for your ATM card or waiting for Aadhaar OTPs.

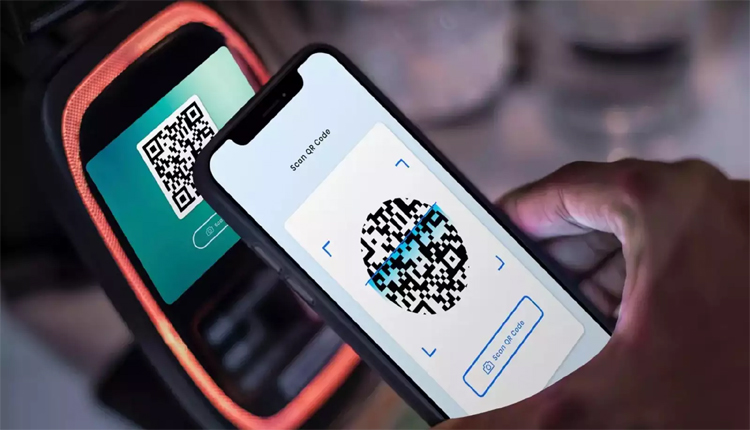

The National Payments Corporation of India (NPCI) has rolled out a game-changing update, allowing users to set or reset their UPI PIN using just a face scan— making digital payments smoother and scam-proof.

In a bid to enhance user convenience, NPCI has integrated Aadhaar-linked biometric authentication via UIDAI’s face recognition technology. This nifty feature bypasses the old hassles of card credentials or OTPs and is especially handy for those moments when your debit card is tucked away at home.

Going by reports, this card-free option serves as a seamless alternative, ensuring you stay connected to your funds without a hitch.

The move isn’t just about ease — it’s a fortress against fraud. With every face uniquely etched like a personal barcode, hackers will find it near impossible to crack. UPI scams have long plagued users, leading to hefty financial losses, but this biometric shield adds an ironclad layer of security. “Your face is your key,” quips an NPCI spokesperson, underscoring how the system safeguards everyday transactions.

From street vendors to salary credits, UPI has revolutionised India’s cashless economy. This tweak promises to elevate the experience further, cutting out the clutter for over 300 million users. So next time PIN panic strikes, just smile at your screen — your wallet’s rescue is a selfie away.

Comments are closed.