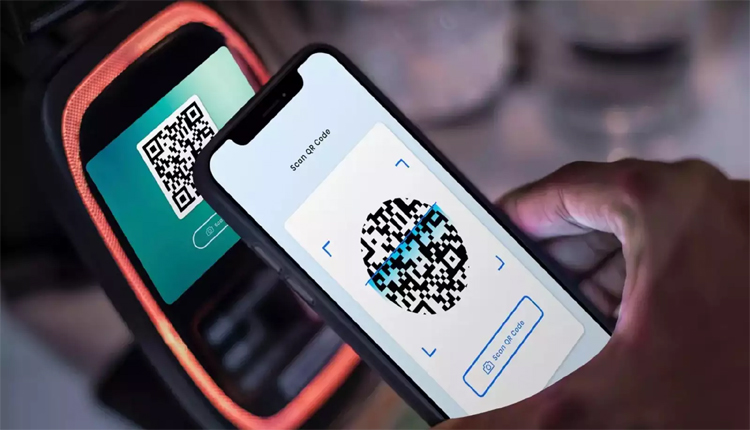

Mumbai: Monday evening turned chaotic across India as a massive outage crippled the country’s digital payment systems, leaving millions unable to cash out. Popular platforms such as Paytm, Google Pay, and PhonePe ceased operations, causing nationwide disruptions to online payments. This revealed the vulnerability of India’s renowned Unified Payments Interface (UPI) network. For shopkeepers, cab drivers, and everyday consumers, the sudden breakdown was a frustrating reminder of the system’s vulnerabilities.

Social media erupted with complaints, as users flooded platforms like Facebook and Instagram with tales of failed transactions. Websites like DownDetector recorded a surge in reports, with Paytm users greeted by a blunt error message: “UPI app is facing some issues.” It quickly became clear that the problem wasn’t limited to one app but stemmed from a broader technical glitch paralysing the entire UPI ecosystem, which handles billions of transactions monthly.

This marks the third such outage in just a month, raising alarm among the millions who rely on UPI daily. “It’s getting ridiculous,” posted one user on X, echoing growing frustration. Small businesses and gig workers, heavily dependent on instant payments, were hit hardest, with many forced to revert to cash or turn away customers. The repeated crashes are testing the patience of a nation that has embraced digital payments with fervour.

Just weeks ago, in March 2025, UPI set a global record, processing 18.3 billion transactions worth ₹24.77 lakh crore (approximately $295 billion), a 5% jump from February. PhonePe took the lead, managing 8.647 billion transactions, or nearly 47% of the total, while Google Pay accounts for over 36%. Together, these giants dominate India’s digital payment landscape. However, their reliability took a hit when servers buckled under Monday’s strain, leaving users stranded.

The outages cast a shadow over India’s ambitious push for a cashless economy, often hailed as a cornerstone of the “Digital India” vision. With UPI’s meteoric rise fueling everything from street vendors to corporate deals, questions are mounting about whether technical glitches could derail this progress. As the National Payments Corporation of India (NPCI), which oversees UPI, works to restore stability, consumers are left wondering if their trust in digital payments is misplaced. For now, India’s digital revolution faces a critical resilience test.

Comments are closed.